Ayşegül İşcanoğlu, Ralf Korn, Ömür Uğur, Constant Proportion of Debt Obligations under the Geometric Brownian Asset Dynamics, in: Readings in Social Sciences of The Second International Conference on Social Sciences organized by Social Sciences Research Society, ICSS 2009, İzmir, Turkey, September 10-11, 2009, pp. 139-152.

Abstract

The structured credit product is a way for managing the credit risk on firms, banks or institutions. By means of these products credit risk is transformed to one party to another. These products are a major consequence of the innovations after the 1988 Basel Capital Record.

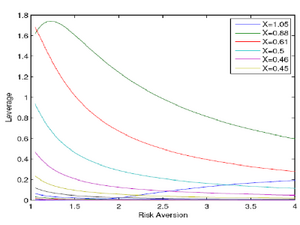

In the study, we examine the newly developed product: Constant Proportional Debt Obligations (CPDOs). Our aim is to find the leverage optimally. In this purpose, we use the Dynamic Programming techniques in the analysis part.

Keywords: CPDOs, dynamic programming, Legendre transform