Burcu Aydoğan, Ph.D.

Department of Financial Mathematics

March 2021

Supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Co-Supervisor: Ümit Aksoy (Department of Mathematics, Atılım University, Ankara)

Abstract

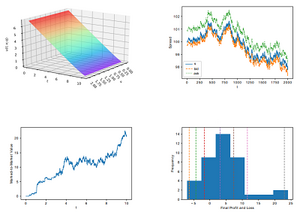

In this thesis, we aim to develop optimal trading strategies in a limit order book for high-frequency trading by stochastic control theory. First, we address for evolving optimal prices where the underlying asset follows the Heston stochastic volatility model including jump components to explore the effect of the arrival of the orders. The goal of the market maker is to maximize her expected return while controlling the inventories where the remaining is charged with a liquidation cost. Two types of utility functions are considered: quadratic and exponential with a risk averse degree, respectively. Then, we study on a model considering an underlying asset with jumps in stochastic volatility. We derive the optimal quotes for both models under the assumptions. For the numerical simulations, we apply finite differences and linear interpolation as well as extrapolation methods to obtain a solution of the related Hamilton-Jacobi-Bellman (HJB) equation. We demonstrate the risk metrics of the models including profit and loss distribution (PnL), standard deviation of PnL and Sharpe ratio which play important roles for the trader to make decisions on the strategies in high-frequency trading. Moreover, we provide the comparisons of the strategies with the existing ones. As a real data application, we conduct our simulations for the developed strategies in this thesis on a high-frequency data of Borsa Istanbul (BIST). For this purpose, we first estimate the parameters of each model and then perform the numerical experiments on the optimal quotes. Furthermore, we provide the applications on global stocks in order to see that the models are applicable, reasonable, and profitable also for the developed markets. Lastly, we take into account of the optimal market making models with stochastic latency impact. We contribute to this study by providing the numerical experiments with an artificial data. Finally, the thesis ends up with a conclusion and future research directions.

Keywords: Market making, Limit order book, High-frequency trading, Stochastic control, Hamilton-Jacobi-Bellman equation, Emerging market