Hüseyin Şentürk, M.Sc.

Department of Financial Mathematics

August 2008

Supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Co-supervisor: Kasırga Yıldırak (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Abstract

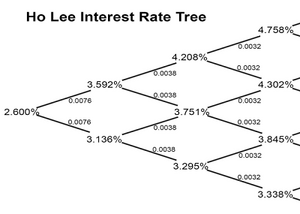

The aim of this study is to compare the performance of the four interest rate models (Vasicek Model, Cox Ingersoll Ross Model, Ho Lee Model and Black Derman Toy Model) that are commonly used in pricing zero coupon bond options. In this study, 1-5 years US Treasury Bond daily data between the dates June 1, 1976 and December 31, 2007 are used. By using the four interest rate models, estimated option prices are compared with the real observed prices for the beginning work days of each months of the years 2004 and 2005. The models are then evaluated according to the sum of squared errors. Option prices are found by constructing interest rate trees for the binomial models based on Ho Lee Model and Black Derman Toy Model and by estimating the parameters for the Vasicek and the Cox Ingersoll Ross Models.

Keywords: zero-coupon bond options, interest rate models, Vasicek model, Cox Ingersoll Ross model, Ho Lee model, Black Derman Toy model, Arrow-Debreu prices