Meral Şimşek, M.Sc.

Department of Actuarial Sciences

June 2016

Supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Co-supervisor: A. Sevtap Selçuk-Kestel (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Abstract

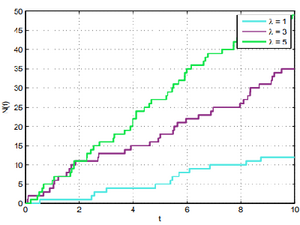

The theory of ruin is a substantial study for those who are interested in financial survival probability based on the patterns imposed by the surplus process, which determines the insurer’s capital balance at a given time. In other words, fluctuations in aggregate claims as well as premiums in such processes can be secured by a certain capital. In this study, we simulate various surplus processes under different claim size-distribution assumptions and extend the analyses by adding perturbation of a Brownian motion in order to capture the possible uncertainty on aggregate claims as well as premiums. The capital, which is required to prevent an insurance company from possible losses, is achieved by using the capital-based risk measures, such as the Value-at-Risk (VaR) and the Conditional Value-at-Risk (CVaR) associated to the surplus process. Findings of the thesis fill a gap in the related literature, especially for the claim size distributions whose closed-form expressions for the ruin probabilities cannot be obtained. This study sheds light on practitioners who allocate capital by means of VaR and CVaR when ruin is considered.

Keywords: Ruin Theory, Risk Measure, Value-at-Risk, Conditional Value-at-Risk