Ahmet Umur Özsoy, Ph.D.

Department of Financial Mathematics

January 2023

Supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Abstract

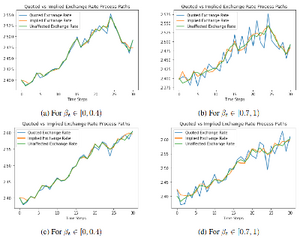

In our study, we make use of reinforcement learning by considering European options written on the exchange rates. For this purpose, we represent and later reformulate an option pricing model, the QLBS model, taking its roots from reinforcement learning. We first devise the QLBS model to be presented in exchange rates. We provide numerical illustrations as well as further insights in regard to exchange rate markets. In second part, we offer several extensions with one developed theoretically yet left as a further study. We suggest different state construction and later on test our extension in comparison. In a later part of this, we also employ jumps that could occur and observe how the QLBS model reacts. We reformulate the QLBS model under market impacts by introducing a large agent whose transactions leave a permanent impact in the foreign exchange rate markets. We offer a completely different approach with the aims of enrichment and contribution to the machine learning in option pricing under market impacts. Through all parts, we obtain convergences to the benchmark prices, and discuss that our reformulations and extensions based on the QLBS model could be an alternative to the traditional option pricing models.

Keywords: reinforcement learning, option pricing, agent-based modeling, market impacts, large trader