Özge Tekin, Ph.D.

Department of Financial Mathematics

August 2022

Supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Co-Supervisor: Rogemar S. Mamon (Statistical and Actuarial Sciences Department, Western University, Canada)

Abstract

Economic and financial data display diverse behavior at different time intervals due to their dynamics and stochastic nature. To build explanatory models, different time periods with similar characteristics can be grouped together under a single regime. In this study, it is assumed that the states of the economy follow a homogeneous first-order continuous-time finite-state hidden Markov chain process.

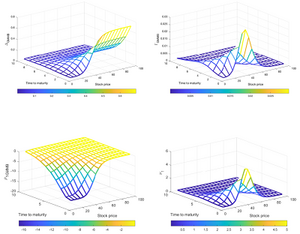

We consider the valuation of European options in a three-state Markov switching extension of the Black-Scholes-Merton framework. In this context, the interest rate, drift, and volatility parameters of the underlying asset depend on the underlying market regime that switches among a finite number of states. Due to the additional source of randomness caused by the underlying Markov chain, the market is incomplete. The regime switching Esscher transform is applied to determine the equivalent martingale measure. Under this measure, the analytical formula for the regime-switching European options is derived. The option pricing procedure under this model has been studied in the literature for the two-state regime-switching framework. In this thesis, we utilize the joint density function of occupation times of the Markov chain proposed by Falzon to obtain the analytical solution for the three-state model. The calculations of the Greeks for the regime-switching European option by using the proposed method are presented.

Some of the exotic options can be represented in terms of the European options. We also consider this relationship for the barrier options and show how our method can be extended for both the valuation of regime-switching barrier options and their Greeks. The validity of the method is illustrated by presenting several examples and comparing them with the results existing in the literature.

Lastly, we consider the regime-switching guaranteed minimum maturity benefit valuation. Considering the long life of variable annuity contracts, insurance providers need to take into account both interest rate and mortality fluctuations in addition to stock market fluctuations. We consider interest rate, mortality, and underlying fund dynamics to be switching among the states, and we propose the formulae for two different models by assuming independent filtration for the mortality component. The first model assumes that both financial and mortality parameters are regulated by the same underlying Markov chain. On the other hand, the second model assumes that the parameters of the mortality model are based on a separate second Markov chain. This study is complemented with some numerical examples to highlight the implication of our approach on pricing these contracts under a regime-switching framework.

Keywords: Regime-switching models, Markov chain, occupation time, European options, barrier options, guaranteed minimum maturity benefit