Süleyman Cengizci, Ömür Uğur, A Computational Study for Pricing European- and American-type Options under Heston's Stochastic Volatility Model: application of the SUPG-YZβ Formulation, Computational Economics, 66: pp. 179 - 206, (August 2024, July 2025).

Abstract

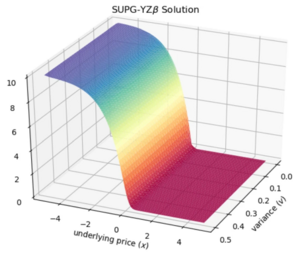

The interest of this paper is stabilized finite element approximations for pricing European- and American-type options under Heston’s stochastic volatility model, a generalization of the eminent Black–Scholes–Merton (BSM) framework in which volatility is treated as a constant. For spatial discretizations, the streamline-upwind/Petrov–Galerkin (SUPG) stabilized finite element method is used. The stabilized formulation is also supplemented with a shock-capturing mechanism, the so-called YZ\(\beta\) technique, in order to resolve localized sharp layers. The semi-discrete problems, i.e., the systems of time-dependent ordinary differential equations, are discretized in time with the Crank–Nicolson (CN) time-integration scheme. The resulting nonlinear algebraic equation systems are solved with the Newton–Raphson (NR) iterative process. The stabilized bi-conjugate gradient method, preconditioned with the incomplete lower–upper factorization technique, is employed for solving linearized systems. The linear complementarity problems arising in simulating American-type options are handled with an efficient and practical penalty approach, which comes at the cost of introducing a nonlinear source term to the fully discretized formulation. The in-house-developed solvers are verified first for the Heston model with a manufactured solution. Following that, the performances of the proposed method and techniques are evaluated on various test problems, including the digital options, through comparisons with other reported results. In addition to those studied previously, we also introduce new "challenging" parameter sets through which Heston’s model becomes much more convection-dominated and demonstrate the robustness of the proposed formulation and techniques for such cases. Furthermore, for each test case, the results obtained with the classical Galerkin finite element method and SUPG alone without shock-capturing are also presented, revealing that the SUPG-YZ\(\beta\) does not degrade the accuracy by introducing excessive numerical dissipation.

Keywords: Heston’s model, Option pricing, Stochastic volatility, SUPG, Shock- capturing