Abdulwahab Animoku, M.Sc.

Department of Financial Mathematics

September 2014

Supervisor: Yeliz Yolcu Okur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Co-supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Abstract

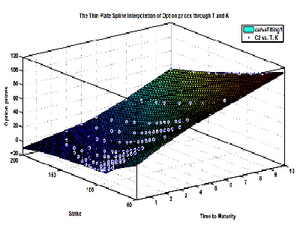

In this thesis, Dupire local volatility model is studied in details as a means of modeling the volatility structure of a financial asset. In this respect, several forms of local volatility equations have been derived: Dupire’s local volatility, local volatility as conditional expectation, and local volatility as a function of implied volatility. We have proven the main results of local volatility model discussed in the literature in details. In addition, we have also proven the local volatility model under stochastic differential equation of the forward price dynamics of asset prices. Consequently, we have studied the two main approaches to obtaining the local volatility surfaces: parametric methods and non-parametric methods. For the parametric method, we have used Dumas parametrization for the implied volatility function which produces implied volatility surface, which in turn is used in obtaining local volatility surface. While in the non-parametric approach for local volatility surfaces, we have used both implied volatilities and option prices data sets with some numerical techniques that are well-founded in literature. As an outlook, we have also discussed several paths this thesis could take for future studies, one of which is using Tikhonov regularization to obtain solutions of local volatilities by solving a regularized Dupire equation.

Keywords: Dumas parametrization, Dupire local volatility model, implied volatility, local volatility surface, parametric method, non-parametric method, Tikhonov regularization