Emine Ezgi Alptekin, Ph.D.

Department of Financial Mathematics

September 2024

Supervisor: Ömür Uğur (Institute of Applied Mathematics, Middle East Technical University, Ankara)

Abstract

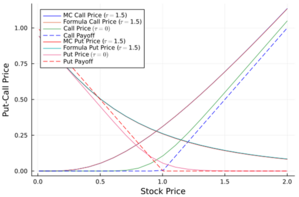

In many fields like physics, ecology, biology, economics, engineering, and financial mathematics, events often don’t have an immediate effect. Instead, they impact future situations. To understand how these systems work and behave, we use stochastic delay differential equations (SDDEs) which are obtained by adding information from past events into stochastic differential equations (SDEs). Thus, SDDEs are gaining attention because they can better reflect real-life situations. Some numerical methods for SDDEs have been developed because it’s often very difficult, and sometimes impossible, to find exact solutions using stochastic calculus. The most known methods are Euler Maruyama and Milstein methods. Recently, researchers in economics and finance have been studying option pricing for systems with time delays, which can be either random or fixed. We aim to understand the general structure of SDDEs while solving them when the time delay is fixed and then use the delayed dynamics for option pricing. The pricing of European vanilla, American vanilla, European foreign exchange and European exchange options whenever underlying dynamics follow delayed geometric Brownian motion (GBM) and European vanilla where the asset price follows the delayed Heston model are considered. Some numerical implementations are carried out to see the effect of delay term on the pricing process.

Keywords: Stochastic delay differential equations, SDDE, option pricing with delay, delayed GBM, delayed Heston model