İ. H. Gökgöz, Ö. Uğur, Y. Yolcu Okur, On the Single Name CDS Price under Structural Modeling, Journal of Computational and Applied Mathematics, 259(B), pp. 406-412, (March 2014).

Abstract

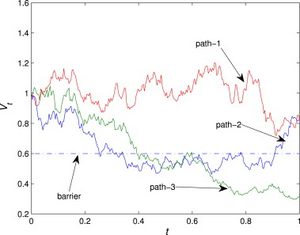

Regulators, banks and other market participants realized that true assessment of the credit risk is more critical and complex than their ex-ante appraisals after the US Credit Crunch. They have turned their attention to complex credit risk models and credit instruments such as credit derivatives. Credit default swap contracts (CDSs) are the most common credit derivatives used for speculation and hedging purposes in the credit markets. Thus, in this paper we fundamentally study the pricing of a single name CDS via the discounted cash flow method with survival probability functions of two pioneer structural credit risk models, Merton model and Black–Cox model with constant barrier. Hence, this approach is not only a new one, but also provides a practical technique to price CDSs using publicly available data of equity returns.

Keywords: Credit Risk, Credit Crisis, Credit Derivatives, Structural Models, Credit Default Swap